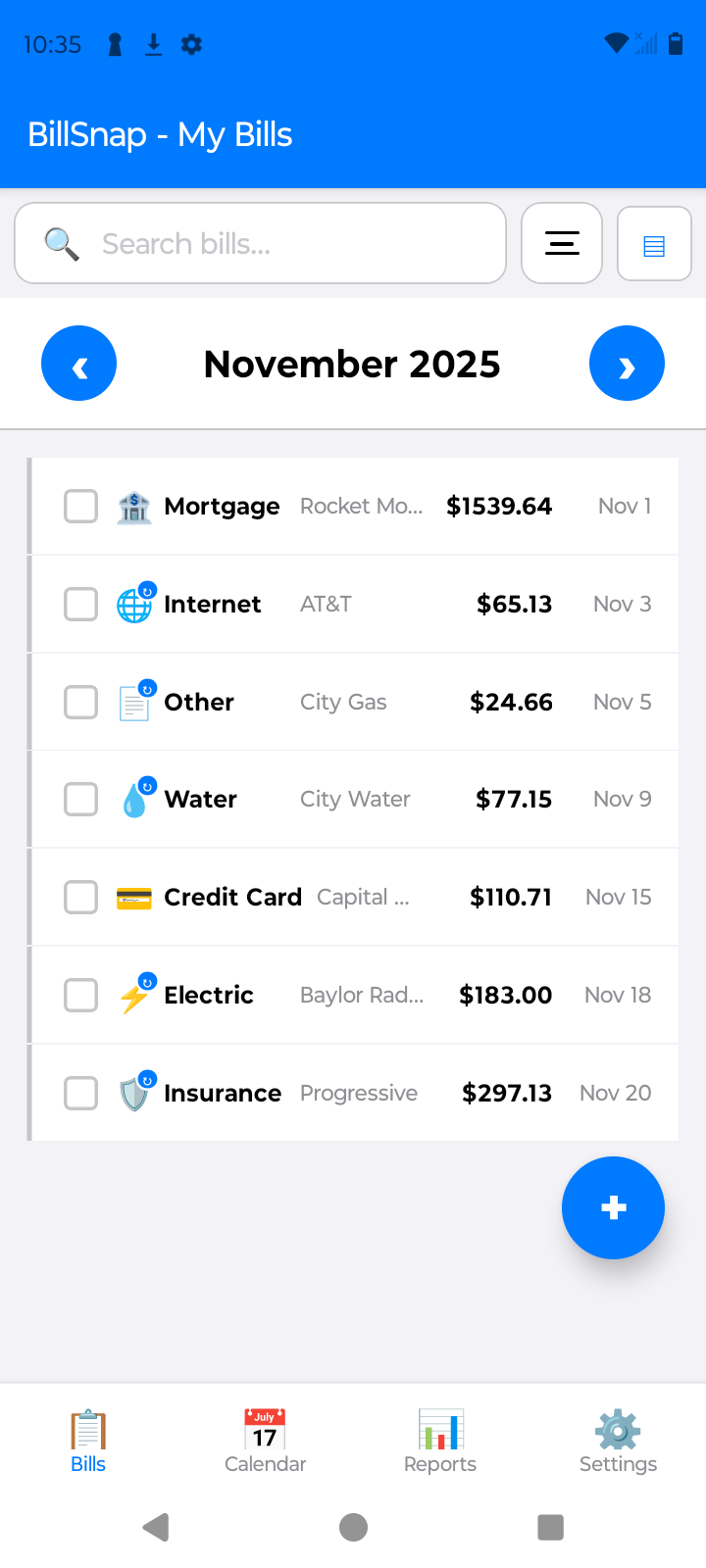

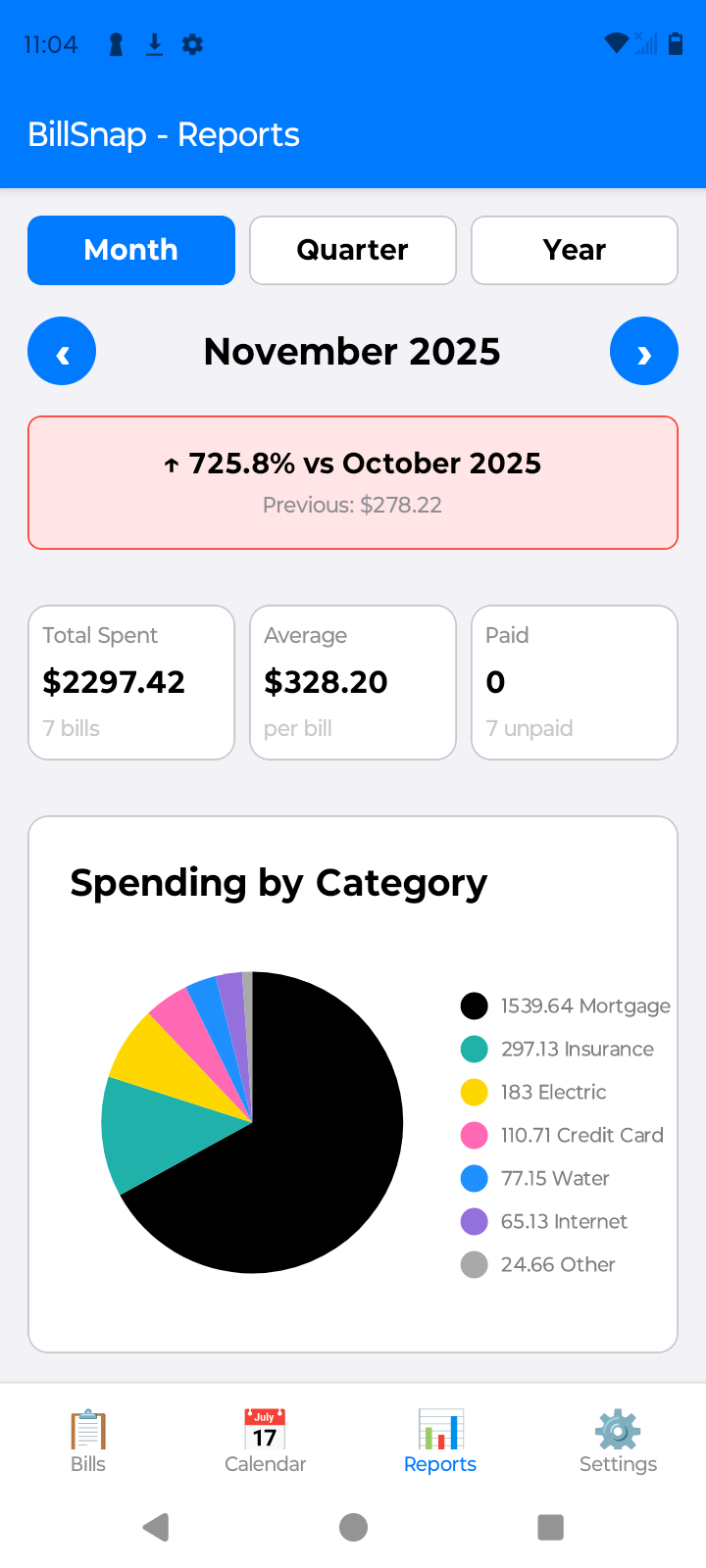

Never Pay Another Late Fee

Stop losing bills. Start saving money.

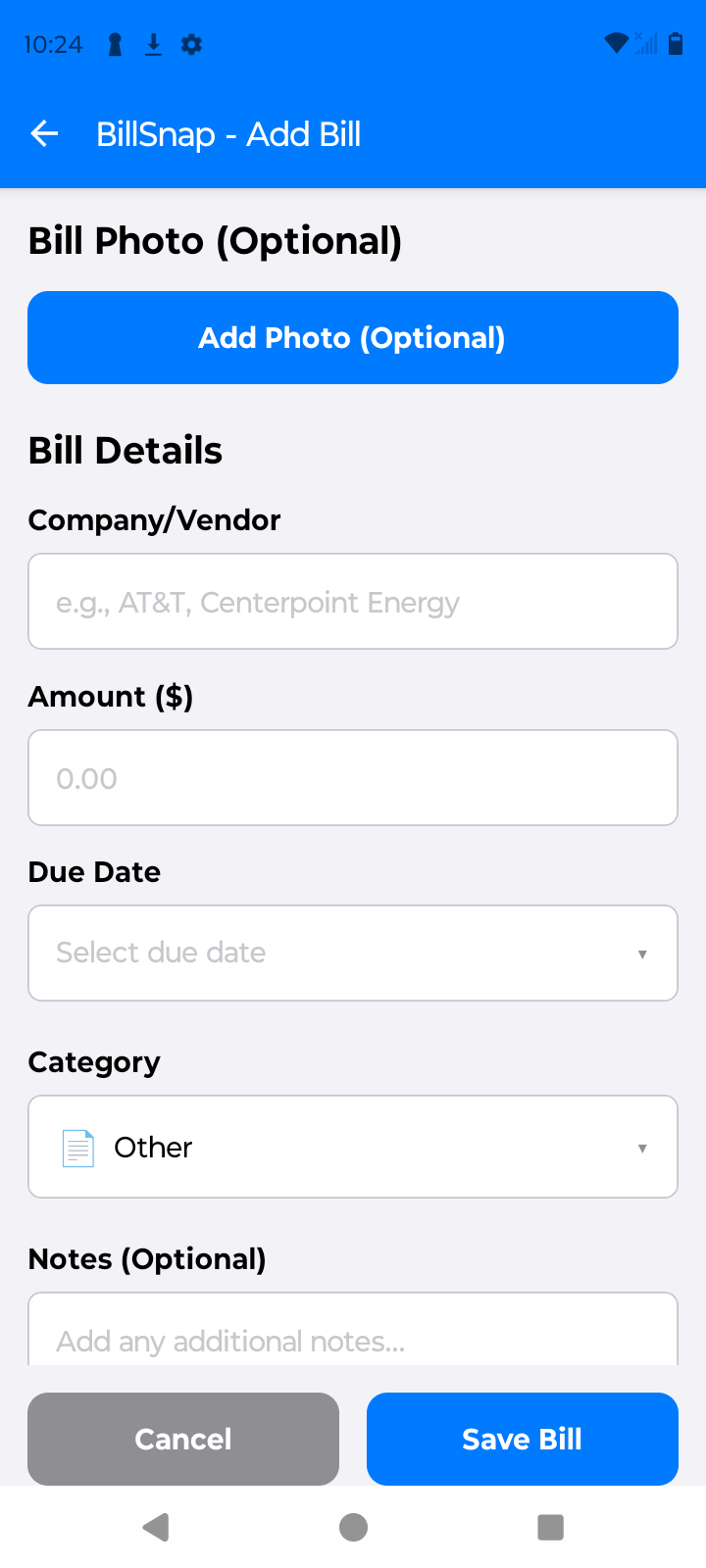

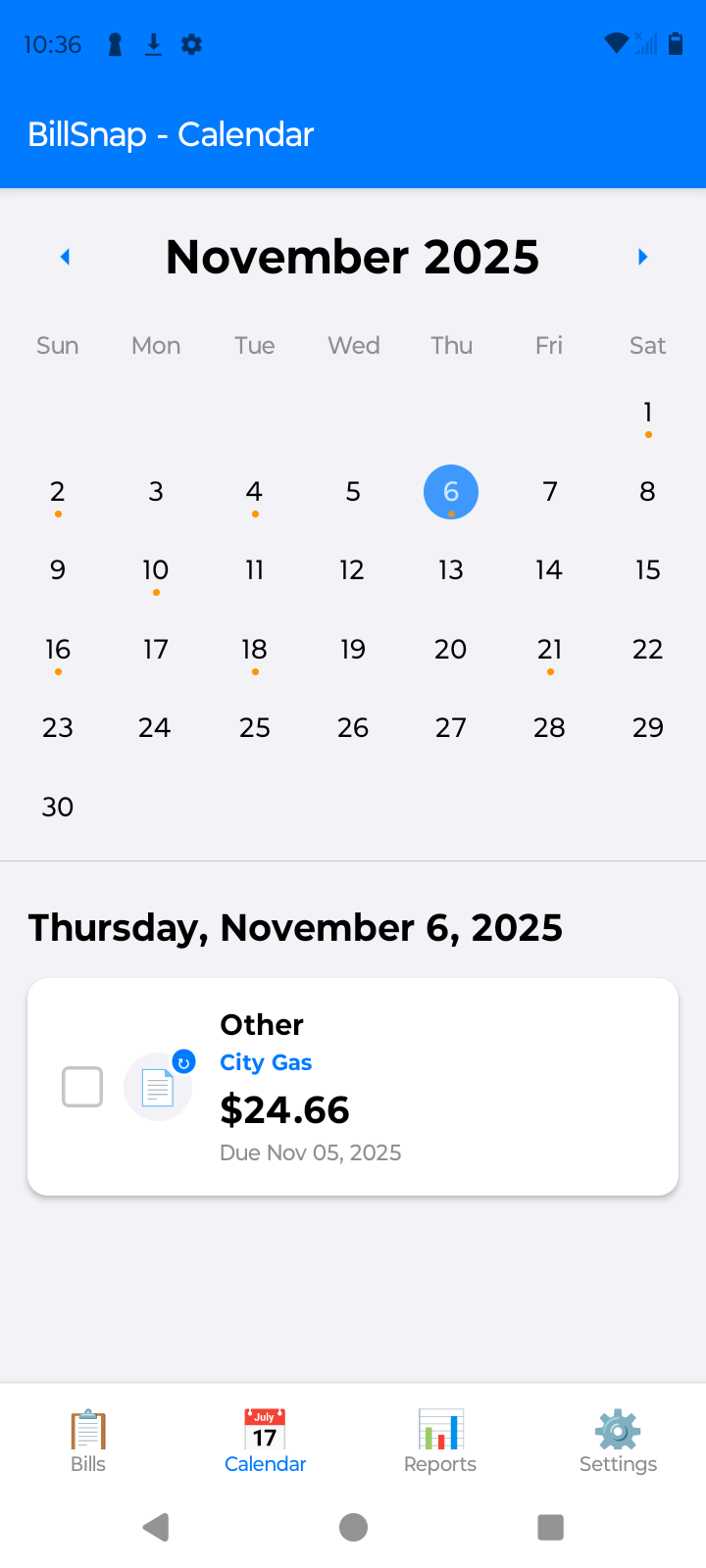

Take a photo of any bill—paper, PDF, or screenshot—and let AI extract all the details automatically. Get reminded before payments are due. Never stress about bills again.

Start free with 8 bills • Upgrade for unlimited bills + income tracking

Try Premium free for 7 days • Cancel anytime